Understanding AI bias in banking

As banks invest in AI solutions, they must also explore how AI bias impacts customers and understand the right and wrong ways to approach it. AI systems could unfairly decline new bank account applications, block payments and credit cards, deny loans, and other vital financial services and products to qualified customers because of how their […]

Read More

Racist Robots? How AI bias may put financial firms at risk

Artificial intelligence (AI) is making rapid inroads into many aspects of our financial lives. Algorithms are being deployed to identify fraud, make trading decisions, recommend banking products, and evaluate loan applications. This is helping to reduce the costs of financial products and improve th… Through a case study of mortgage applications, this article shows how […]

Read More

AI risks replicating tech’s ethnic minority bias across business

Diverse workforce essential to combat new danger of ‘bias in, bias out’ This short article looks at the link between the lack of diversity in the AI workforce and the bias against ethnic minorities within financial services – the “new danger of ‘bias in, bias out’”.

Read More

Black Loans Matter: fighting bias for AI fairness in lending

Today in the United States, African Americans continue to suffer from financial exclusion and predatory lending practices. Meanwhile the advent of machine learning in financial services offers both promise and peril as we strive to insulate artificial intelligence from our own biases baked into the historical data we need to train our algorithms. A detailed […]

Read More

Algorithms and bias: What lenders need to know

Much of the software now revolutionising the financial services industry depends on algorithms that apply artificial intelligence (AI) – and increasingly, machine learning – to automate everything from simple, rote tasks to activities requiring sophisticated judgment. Explains (from a US perspective) how the development of machine learning and algorithms has left financial services at risk […]

Read More

AI Perpetuating Human Bias in the Lending Space

AI was supposed to be the pinnacle of technological achievement — a chance to sit back and let the robots do the work. While it’s true AI completes complex tasks and calculations faster and more accurately than any human could, it’s shaping up to need some supervision. There is data which predicts that the introduction […]

Read More

Reducing bias in AI-based financial services

The impact of artificial intelligence in consumer lending. This US focused report considers four distinct ways of incorporating Artificial Intelligence into credit lending. It highlights the existing racial bias in credit scores, where white / non-hispanic individuals are likely to have a much higher credit score than black / African American individuals. And argues that […]

Read More

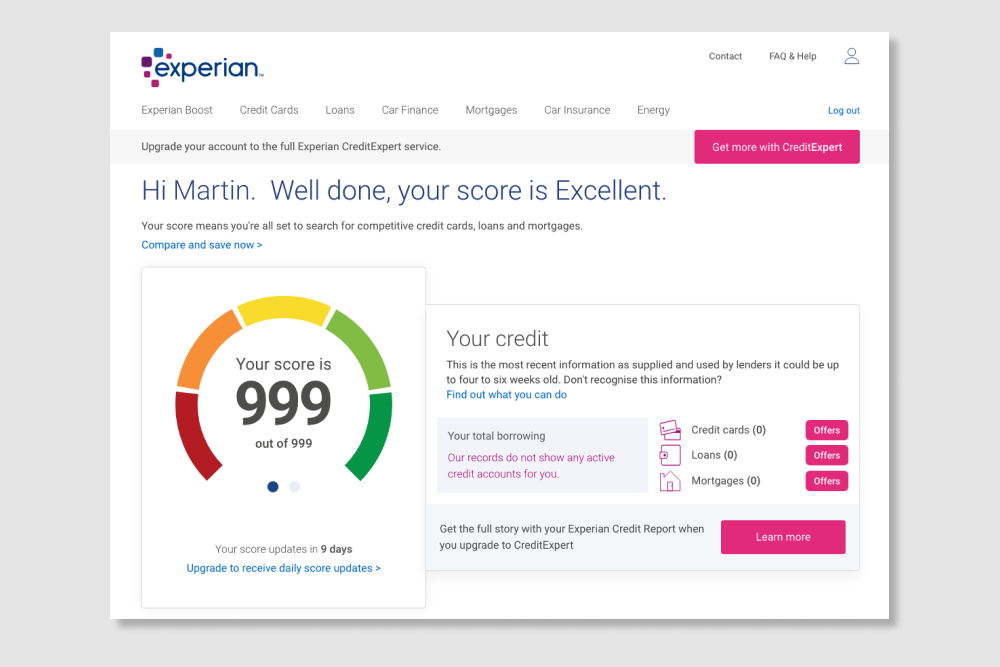

Credit Scoring and Interest Rates

Minority groups are often treated as high risk (more likely to not pay money back) because of the use of proxy data in financial institutions. This means that people from minority ethnic groups can find it hard to get credit, and get offered higher interest rates, widening poverty gaps.

Read More

Access to Bank Accounts, Loans and Mortgages

Algorithms can be used to decide when to withhold loans, mortgages and even bank accounts, on the basis of who is likely to make money for the bank. Minority ethnic groups can be disproportionately disadvantaged within these prediction systems by being determined as not meeting the criteria for lending, even when others with the same financial status get approved.

Read More